Top Strategies on How to Avoid Probate in Mississippi

Want to avoid probate in Mississippi? This guide will show you how to avoid probate in Mississippi and ensure your assets go directly to your heirs without the delays and costs of probate. We’ll cover methods like setting up revocable living trusts, jointly owning property, and other practical tips. Read on to learn reliable strategies for bypassing probate in Mississippi.

Key Takeaways

- Establishing a revocable living trust allows assets to bypass probate, providing privacy and control over your estate.

- Joint ownership with right of survivorship simplifies asset transfer by automatically passing ownership to surviving owners without probate.

- Payable-on-death (POD) designations and transfer-on-death (TOD) registrations help transfer financial accounts and vehicles directly to beneficiaries, avoiding complexities of probate.

Establishing a Revocable Living Trust

One of the most effective estate planning tools to avoid probate is establishing a revocable living trust. This legal arrangement places your assets under the control of a trustee for the benefit of your chosen beneficiaries. The primary advantage of a revocable living trust is its ability to bypass the probate process entirely. When the owner dies, the assets within the trust pass directly to the beneficiaries without the need for court intervention, providing ways to avoid probate.

Creating a revocable living trust involves transferring ownership of your assets to yourself as the trustee. This process ensures that you retain control over your property during your lifetime. Upon your death, a successor trustee takes over, managing and distributing the assets according to your wishes. This seamless transition not only avoids probate but also maintains the privacy of your estate, as trust distributions are not part of the public record.

One of the significant benefits of a revocable living trust is its flexibility. You can modify or revoke the trust at any point during your life, allowing you to adapt your estate plan as circumstances change. This flexibility, combined with the ability to maintain confidentiality regarding asset distribution, makes revocable living trusts a popular choice for those looking to avoid probate.

Estate planning attorneys can be invaluable when setting up a revocable living trust. They assist in crafting legal documents and educate you on your rights and options. Their expertise tailors your estate plan to your specific needs, maximizing the benefits of avoiding probate.

Utilizing Joint Ownership with Right of Survivorship

Another effective method to avoid probate is utilizing joint ownership with right of survivorship. In Mississippi, joint ownership allows property to pass directly to the surviving owner without going through the probate process. This method ensures a smooth and efficient transfer of assets, reducing the stress and complexity associated with probate.

Joint ownership requires equal ownership shares among all joint tenants. This arrangement is particularly beneficial for married couples, who can opt for tenancy by the entirety, a form of joint tenancy exclusive to them in Mississippi. When one owner dies, the surviving joint owner automatically inherits the entire property, bypassing probate entirely.

However, knowing the limitations and requirements of joint ownership is crucial. While it simplifies the transfer process, it also means that each owner has an equal share and cannot independently sell or transfer the property without the other’s consent. Despite these limitations, joint ownership remains a straightforward and efficient way to avoid probate, ensuring that your assets transfer smoothly to your beneficiaries.

Setting Up Payable-on-Death Designations for Financial Accounts

Setting up payable-on-death (POD) designations is another straightforward method to avoid probate. A POD designation allows the account holder to name beneficiaries who will receive the funds directly upon the account owner’s death, ensuring that the assets are transferred without complications for the deceased person. This designation can be applied to various financial accounts, including savings accounts, checking accounts, and certificates of deposit, providing a hassle-free way to transfer assets.

One of the significant advantages of POD accounts is that the account holder retains full control over their funds during their lifetime. This means you can manage, withdraw, or deposit money as usual, and the designated beneficiaries have no access to the funds until your death. Upon the account owner’s death, the beneficiaries can access the funds directly from the bank accounts, bypassing the probate process entirely.

POD designations are flexible and can be changed or revoked at any point during the account holder’s lifetime. This flexibility, combined with the simplicity and efficiency of the transfer process, makes POD accounts an attractive option for those looking to streamline their estate planning and avoid probate.

Transfer-on-Death Registration for Securities and Vehicles

Transfer-on-death (TOD) registration is another effective strategy to avoid probate, particularly for securities and vehicles. This registration allows these assets to pass directly to named beneficiaries upon the owner’s death, without the need for probate. This method ensures a smooth and efficient transfer, similar to payable-on-death designations for financial accounts and transfer on death deeds.

To register a security as TOD, the owner must complete specific forms with their brokerage firm. This process is straightforward and ensures that the designated beneficiary inherits the account automatically upon the owner’s death. Similarly, Mississippi law allows for the TOD registration of vehicles, simplifying the inheritance process and eliminating the need for probate.

The benefits of TOD registrations are clear: they provide a hassle-free way to transfer ownership of securities and vehicles, reducing the time, cost, and complexity associated with probate. By planning ahead and setting up TOD registrations, you can ensure that your beneficiaries receive these assets quickly and efficiently.

Using Life Estate Deeds

Life estate deeds are another valuable tool in avoiding probate. A life estate deed allows the property owner to transfer ownership while retaining the right to use the property for their lifetime. This arrangement ensures that the property remains within the family or designated beneficiaries without going through the probate process.

When the grantor passes away, the life estate automatically ends, and the property transfers to the designated beneficiary without needing probate. This automatic transfer simplifies the process and ensures that the property is passed on as intended. Additionally, the grantor retains the right to use and live on the property during their lifetime, providing security and stability.

Life estate deeds are particularly beneficial in estate planning, as they provide a way to ensure property remains within the family while avoiding the complexities of probate. By utilizing life estate deeds, you can plan for the future and protect your assets effectively.

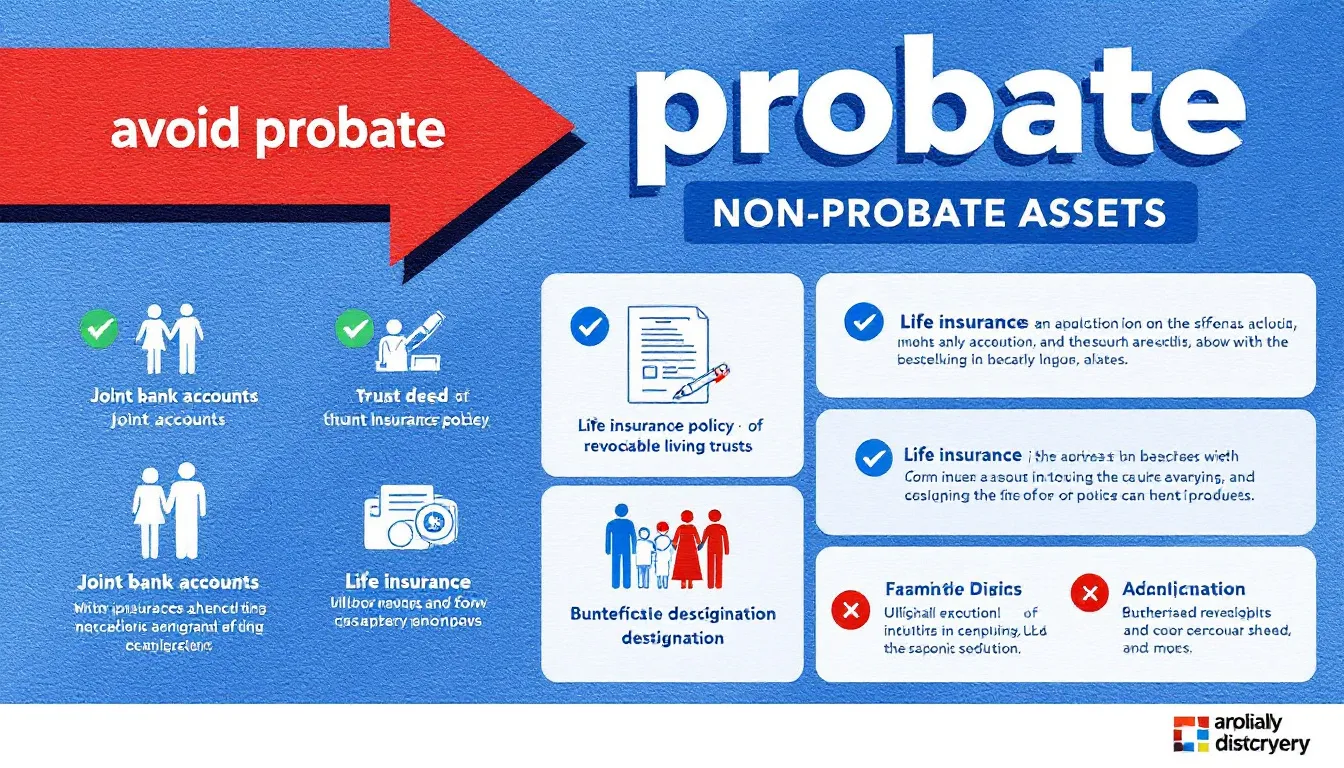

Identifying Other Non-Probate Assets

Identifying other non-probate assets is crucial in creating a comprehensive estate plan. Many assets can be transferred directly to beneficiaries, bypassing the probate process entirely. For example, life insurance policies and retirement accounts are typically paid directly to the named beneficiaries without court involvement.

Transfer-on-death registrations for securities and vehicles also fall into this category, allowing these assets to pass directly to beneficiaries upon the owner’s death. Mississippi law facilitates the direct inheritance of stocks, bonds, and other securities, further simplifying the estate planning process.

By identifying and categorizing these non-probate assets, you can streamline your estate plan and ensure that your beneficiaries receive their inheritance quickly and without unnecessary legal hurdles. This proactive approach is a key component of effective estate planning.

Simplified Probate Procedures for Small Estates

For small estates, Mississippi offers simplified probate procedures that can significantly reduce the complexity and cost of settling an estate. One such method is the small estate affidavit, which allows heirs to collect personal property without going through the full probate process, provided specific conditions are met.

Mississippi law allows less stringent notice requirements for estates valued at $500 or less, eliminating the need for newspaper publication. These simplified procedures make it easier for families to manage their loved one’s affairs, reducing stress and legal expenses.

Taking advantage of these simplified probate procedures ensures a smoother and more efficient distribution of small estates. This method is particularly helpful for families with modest assets, providing a practical way to avoid probate complications.

The Role of Estate Planning Attorneys

Experienced estate planning attorneys are crucial for creating a comprehensive estate plan that avoids probate effectively. They provide valuable guidance and expertise, tailoring your estate plan to your specific needs and circumstances. A well-crafted estate plan can simplify or even avoid the probate administration process, providing peace of mind for you and your loved ones.

The legal team at Shows & Smith Law Firm, for example, has over 70 years of collective experience in estate planning. Their expertise includes navigating potential tax considerations, such as gift taxes and capital gains taxes, which may arise when creating a life estate. Working with knowledgeable attorneys ensures your estate plan maximizes benefits and minimizes potential pitfalls.

In conclusion, involving estate planning attorneys in your legal process is essential for creating an effective and efficient estate plan. Their guidance can help you avoid probate, protect your assets, and ensure that your wishes are honored.

Summary

In summary, there are several strategies to avoid probate in Mississippi, each with its unique benefits and considerations. From establishing a revocable living trust to utilizing joint ownership with right of survivorship, and from setting up payable-on-death designations for financial accounts to using life estate deeds, these methods can help ensure a smooth transfer of assets to your beneficiaries.

Proactive estate planning is essential for protecting your assets and providing peace of mind for your loved ones. By understanding and implementing these strategies, you can avoid the complexities of probate and ensure that your estate is managed according to your wishes.

Frequently Asked Questions

What is a revocable living trust and how does it help avoid probate?

A revocable living trust is an estate planning tool that allows you to control your assets while you’re alive and ensures they go directly to your chosen beneficiaries when you pass. This helps avoid probate, saving time and money by skipping the court process entirely.

How does joint ownership with right of survivorship work?

Joint ownership with right of survivorship means that when one owner passes away, their share of the property automatically goes to the surviving owner, bypassing probate. It’s a straightforward way to ensure your property stays within your chosen circle without legal delays.

What are payable-on-death designations and which accounts can they be applied to?

Payable-on-death (POD) designations let you name beneficiaries to receive your funds directly after you pass away. They can be used for accounts like savings accounts and certificates of deposit.

What is a life estate deed and how does it avoid probate?

A life estate deed lets you keep using your property for life while designating who will get it after you pass away, ensuring it avoids probate. This means your loved ones can inherit the property smoothly and quickly, without the hassle of court proceedings.

Why should I consult an estate planning attorney?

You should consult an estate planning attorney to create a personalized estate plan that avoids probate and effectively meets your needs. Their expertise ensures your wishes are clearly defined and legally sound.