Probate Process Simplified: Everything You Need to Know

Probate is the court-supervised process of managing and distributing a deceased person’s estate. It ensures that debts are paid and assets are given to rightful beneficiaries, either according to the will or state laws if no will exists.

Key Takeaways

- Probate is the legal process for distributing a deceased person’s estate, ensuring debts are settled and assets are allocated per the will or state law.

- Understanding when probate is necessary and which assets are subject to it is essential for effective estate planning and minimizing legal complications.

- Effective estate planning, including the use of wills, living trusts, and beneficiary designations, can simplify the probate process or help avoid it altogether.

Understanding Probate

Probate is the legal process that occurs after someone passes away, involving the court-supervised distribution of the deceased person’s property. The primary purpose of probate is to ensure that the decedent’s estate is managed and distributed according to the deceased’s wishes as outlined in their will, or according to state laws if no will exists. During probate, the decedent’s assets are collected, outstanding debts and taxes are paid, and the remaining assets are distributed to the rightful beneficiaries.

The probate process begins with the submission of a death certificate, which is necessary to prepare a probate file. If the deceased’s debts exceed their assets, probate may not be initiated, as there would be no value to distribute. Certain assets, such as those solely owned by the deceased without a designated beneficiary, require probate for ownership transfer. Once all debts are settled, the remaining property is passed on to the heirs designated by the deceased’s will.

Anyone involved in estate planning or managing a loved one’s estate should understand probate. Familiarity with probate laws and procedures can make navigating this complex legal process easier and help avoid potential pitfalls related to probate law.

When Probate Is Required

Probate is necessary under several circumstances. Here are some common scenarios:

- The absence of a will, where the estate must go through probate to determine the rightful heirs according to intestate succession laws.

- Complex estates or when the validity of a will is disputed.

- Each state has specific probate laws that determine when probate is necessary, often based on factors such as the estate’s value and the types of assets involved.

In some states, small estates can bypass the full probate process if the total value of the assets falls below a certain threshold. Assets owned solely by the deceased generally must go through probate, while jointly owned assets or those with designated beneficiaries may not require probate.

Knowing when probate is required aids in better estate planning and helps avoid unnecessary legal proceedings.

Assets Subject to Probate

Assets subject to probate are those that must go through the probate process to be distributed to the beneficiaries. These typically include any assets solely owned by the deceased without a designated beneficiary. Common probate assets include real estate, vehicles, personal items such as clothing and jewelry, and bank accounts solely in the decedent’s name without a payable-on-death designation.

Investment accounts like stocks and bonds, if only in the decedent’s name, also fall under probate. Business assets owned by the deceased must be appraised and addressed within the probate process. Additionally, tenants-in-common assets, which are co-owned without survivorship rights, are subject to probate.

Knowing which assets are subject to probate helps in creating an estate plan that minimizes probate, simplifying the distribution process for your loved ones.

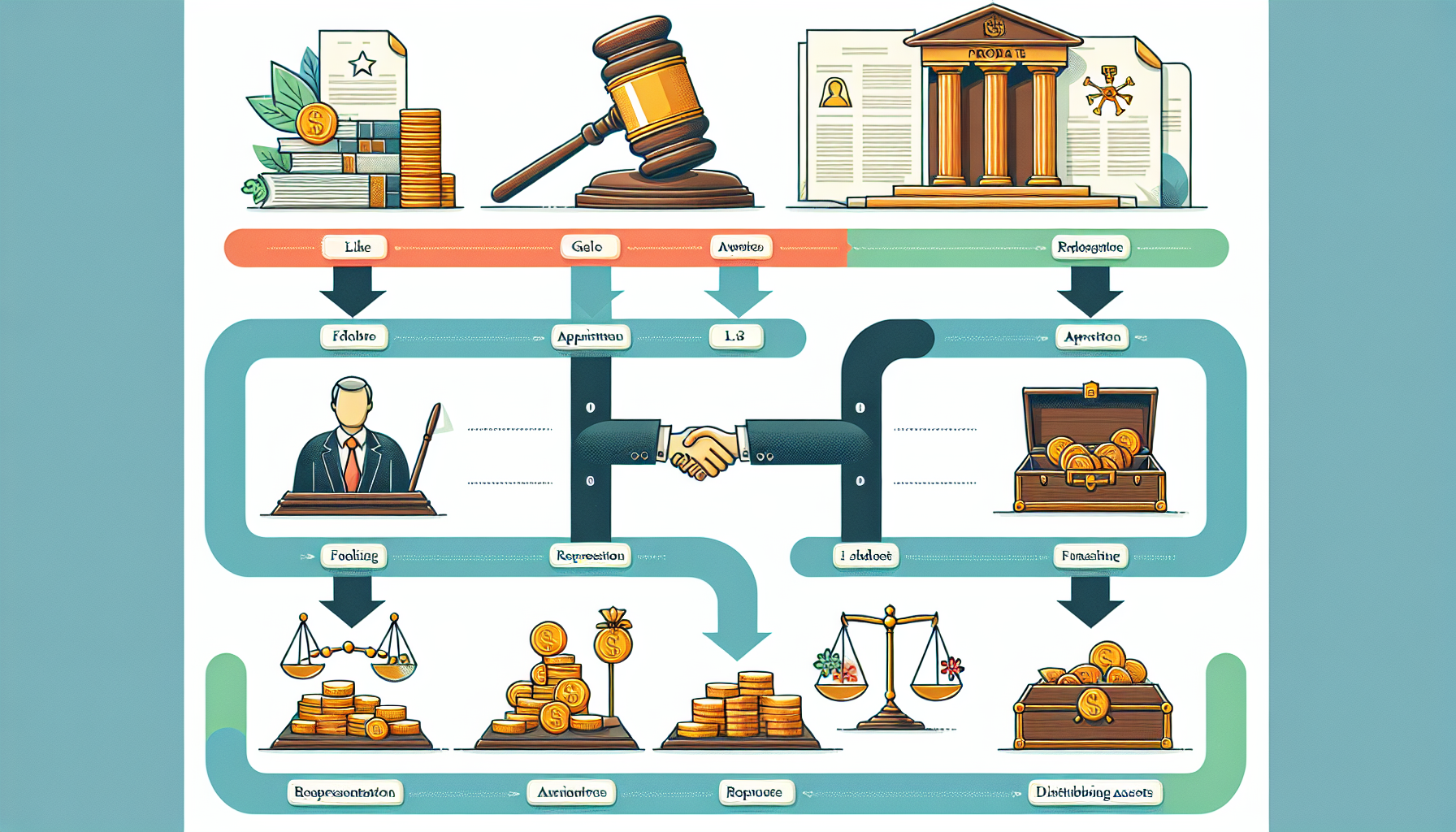

The Probate Process Step-by-Step

The probate process can seem overwhelming, but breaking it down into manageable steps can help demystify it. Here are the steps involved:

- Prepare a probate file and validate the deceased’s assets.

- Depending on the state, smaller estates may be settled through faster, less formal methods.

- Larger or more complex estates require a more formal probate proceeding.

- In some cases, small estates can be claimed by beneficiaries through a notarized affidavit, simplifying the distribution process.

By following these steps, you can navigate the probate process more easily.

The process can be broken down into key steps: filing the death certificate, validating the will, appointing a personal representative, notifying beneficiaries and creditors, inventorying estate assets, paying debts and taxes, and distributing remaining assets.

Filing the Death Certificate

Filing the death certificate is the initial step in the probate process. This crucial document can be submitted to the probate court by the executor or a close family member of the deceased person.

Once the death certificate is filed, the probate court begins the legal proceedings necessary to administer the decedent’s estate.

Validating the Will

Validating the will is a critical step in the probate process. The court must verify that the will meets all legal standards before proceeding with the distribution of the estate. This involves confirming the signatures of the testator and witnesses to ensure the document’s authenticity.

Validating the will is crucial for a smooth probate process.

Appointing a Personal Representative

The probate court appoints a personal representative, often referred to as an executor or administrator, to oversee the probate process. If the will names an executor, the court will typically honor this appointment. In the absence of a will, the court will appoint an administrator based on intestate succession laws.

The personal representative is responsible for managing the decedent’s estate according to the will or state laws.

Notifying Beneficiaries and Creditors

Once the personal representative is appointed, they must notify all beneficiaries and creditors about the probate proceedings. This ensures transparency and allows interested parties to make claims against the estate if necessary.

Communicating effectively with beneficiaries and creditors ensures a smooth probate process.

Inventorying Estate Assets

The personal representative must compile a comprehensive inventory of the deceased’s assets, including both tangible and intangible personal property. This inventory is essential for assessing the estate’s value and ensuring fair distribution among beneficiaries.

A precise inventory aids in managing the probate process and ensures transparency.

Paying Debts and Taxes

Before any assets can be distributed, the estate’s debts and taxes must be paid. This includes settling outstanding funeral expenses, medical bills, and notifying government agencies like the Social Security Administration.

The executor must ensure all debts and taxes are cleared to proceed with the distribute remaining assets of the remaining assets.

Distributing Remaining Assets

After clearing all debts and taxes, the personal representative can seek court approval to distribute the remaining assets to the beneficiaries. The distribution is carried out according to the deceased’s will or, in the absence of a will, according to state intestate succession laws.

This final step ensures that the decedent’s estate wishes are honored, and the beneficiaries receive their rightful inheritance.

Probate Without a Will

When a person dies without a will, the probate process becomes more complex. The court must assign an administrator to manage the intestate estate and distribute the assets according to state laws. Intestate succession laws vary by state and dictate who inherits the estate and in what proportions. This process ensures that the decedent’s estate is handled according to legal standards, even in the absence of a will.

Without a will, the court takes a more involved role in overseeing the probate proceedings to ensure fair distribution among the heirs. The lack of a will can lead to disputes among potential heirs, making the process longer and more costly.

The complexities of probate without a will underscore the importance of having a valid estate plan to avoid such complications.

Costs Involved in Probate

Probate can be a costly process, significantly impacting the estate’s value and the beneficiaries’ inheritances. Legal fees, court fees, and other expenses can quickly add up. Lawyers typically charge probate fees based on hourly rates, flat fees, or a percentage of the estate’s value. Hourly rates can range from $150 to over $250 depending on the attorney’s experience and location, while flat fees offer a more predictable cost structure.

Percentage fee arrangements are based on the gross estate value, which can lead to disproportionately high costs, especially for larger estates. To avoid disputes and manage costs, it is advisable to have a written fee agreement with the attorney detailing the costs, responsibilities, and payment terms.

Knowing these costs aids in better estate planning and reduces the financial burden on your beneficiaries.

How to Avoid Probate Process

Avoiding probate can save your loved ones time, money, and stress. One effective strategy is to create a revocable living trust, which allows your assets to be owned by the trust and distributed directly to your beneficiaries without court involvement. Joint ownership of assets with rights of survivorship ensures that the assets transfer automatically to the surviving owners upon death, bypassing probate.

Designating beneficiaries for accounts and policies, such as retirement accounts and life insurance policies, allows these assets to pass outside of probate. Payable-on-death (POD) and transfer-on-death (TOD) designations facilitate direct asset transfer to beneficiaries, avoiding probate. Additionally, making lifetime gifts can prevent probate for those assets, as they are given away while you are still alive.

Implementing these estate planning strategies can significantly simplify the distribution process and ensure your assets are managed and transferred according to your wishes. Taking proactive steps ensures peace of mind for you and your loved ones.

Simplifying Probate Through Estate Planning

Effective estate planning is crucial for simplifying or avoiding the probate process. A valid will is the cornerstone of a good estate plan, simplifying the probate process for your loved ones.

The typical probate process involves several essential stages, such as:

- Filing a death certificate

- Submitting the will

- Validating it

- Appointing an executor

- Identifying assets and debts

- Notifying interested parties

- Settling debts

- Distributing remaining assets

Many states offer small estate provisions that simplify or exempt estates below a certain value from probate. Gifting assets before death can avoid probate since these assets no longer form part of your estate.

Planning ahead with a detailed estate plan ensures a smoother transition for your beneficiaries and reduces the complexities of the probate process.

Summary

In summary, understanding and navigating the probate process is crucial for ensuring that your estate is managed and distributed according to your wishes. Whether you are dealing with probate after a loved one’s death or planning your own estate, knowing the steps involved, the assets subject to probate, and the costs can help you make informed decisions. By taking proactive steps and utilizing strategies to avoid probate, you can simplify the distribution process and reduce the financial and emotional burden on your loved ones.

Estate planning is not just about avoiding probate; it’s about ensuring peace of mind and providing for your family’s future. By creating a detailed estate plan, you can bypass many of the complexities associated with probate and ensure a smoother transition for your beneficiaries. Take the time to consult with a probate lawyer and develop a comprehensive plan that aligns with your wishes and goals.

Frequently Asked Questions

What is probate?

Probate is a legal procedure that oversees the distribution of a deceased person’s property, ensuring that debts are paid and assets are allocated according to the law. It serves to facilitate an orderly transition of the estate to the rightful heirs.

When is probate required?

Probate is required when there is no will, when dealing with complex estates, or if there are disputes regarding the will. Additionally, state laws and the estate’s size play a significant role in determining whether probate is necessary.

Which assets are subject to probate?

Assets solely owned by the deceased without a designated beneficiary, including real estate, vehicles, personal items, and solely owned bank accounts, are subject to probate.

How can I avoid probate process?

You can avoid probate by implementing strategies such as establishing a revocable living trust, joint ownership of assets, designating beneficiaries for your accounts and insurance policies, and making lifetime gifts. These actions help ensure your assets are transferred efficiently upon your passing.

What are the costs involved in probate?

Probate costs primarily encompass legal fees, court fees, and other related expenses. Legal professionals often charge either hourly rates, flat fees, or a percentage of the estate’s value, which can significantly affect the total cost.

Contact Us!

We would love to help you simplify or AVOID the probate process! Give us a call at 601.925.9797 to schedule your FREE phone consultation with one of our experienced attorneys.