Determination of Heirship Mississippi: Essential Guide for Families

When someone dies without a will in Mississippi, the determination of heirship Mississippi is essential. This process identifies who inherits the deceased’s assets. Our guide explains the steps involved, from understanding intestate laws to filing necessary petitions and court proceedings.

Key Takeaways

- Mississippi intestate succession laws dictate how deceased individuals’ estates are distributed among heirs, emphasizing the importance of understanding these rules for fair estate management.

- The heirship suit process serves as a streamlined alternative to full probate for determining rightful heirs, requiring the filing of a petition in the chancery court to legally recognize heirs.

- Various factors, including advancements, the Slayer Statute, and escheatment, can significantly influence heirship determination and the final estate distribution in Mississippi.

Understanding Heirship in Mississippi

Heirship refers to the legal status of individuals as potential beneficiaries of an estate when someone dies without a will, known as intestacy. Understanding Mississippi’s intestate succession laws is key to handling a deceased’s estate correctly and fairly. Mississippi law outlines specific rules for distributing property when someone dies without a will, ensuring all heirs receive their rightful shares. Foster children, unlike legally adopted or biological children, do not have legal rights to inherit from a decedent under these laws.

Intestate estates in Mississippi are administered similarly to testate estates (those with a will), but significant differences regarding the distribution of assets exist. Familiarity with Mississippi inheritance laws helps navigate heirship complexities and ensures a smooth transition of intestate property.

Definition of Heirship

Heirship legally recognizes individuals entitled to inherit a deceased person’s assets under Mississippi intestate laws. In Mississippi, heirs include the surviving spouse and blood relatives, encompassing adopted children as well. Establishing heirship requires filing a petition detailing the relationship between the decedent and the claimed heirs, providing clarity and legal standing to these claims. This petition must articulate the relationship of potential heirs to the deceased, ensuring that all the heirs are appropriately identified and recognized.

The determination of heirship in Mississippi can be influenced by various factors, including the decedent’s expressed wishes in a will, state regulations, and the relationships among family members. Knowing who qualifies as an heir and the involved legal processes ensures the deceased’s assets are distributed according to Mississippi’s intestate succession laws.

Legal Framework for Heirship Determination

Mississippi intestate laws govern heirship determination for individuals who die without a will, applying to all assets located within the state, including real estate. These laws dictate specific rules on how different family members inherit when someone dies intestate, ensuring a structured and fair distribution of the estate. The legal framework established by Mississippi law is designed to handle various inheritance scenarios, from straightforward cases involving immediate family to more complex situations with distant relatives.

Determining heirship can be challenging, but understanding the relevant statutes and the chancery court’s role provides clarity. Mississippi’s intestate succession laws ensure that all assets, whether from a simple or complex estate, are distributed according to state regulations.

The Heirship Suit Process

An heirship suit can serve as an alternative to a full intestate probate for determining heirs, often preferred when resolving claims against an estate is not necessary. These suits are legal proceedings aimed at establishing the rightful heirs to a deceased person’s estate, ensuring that all heirs are recognized and their shares distributed accordingly. Heirship suits can simplify the process of transferring estate ownership, especially in cases where there are numerous heirs or complex family dynamics.

Knowing the heirship suit process helps families navigate the legal landscape of inheritance. Filing the necessary petitions and following legal protocols ensures all potential heirs are accounted for and the estate is distributed fairly according to Mississippi law.

Filing an Heirship Petition

Filing an heirship petition is a critical step in obtaining a judicial determination of the heirs to a deceased person’s estate. This process involves gathering necessary documentation, such as the decedent’s death certificate and relevant family records, to support the petition. The document filed to establish heirs is termed a Petition to Establish Heirs, and it must be prepared and submitted to the chancery court.

Proper probate preparation involves understanding state laws and ensuring all necessary documents are in order. An estate planning attorney can help navigate these legal proceedings, ensuring the petition is filed correctly and all potential heirs are recognized.

Role of Chancery Court

The chancery court plays a crucial role in the heirship suit process, adjudicating claims and issuing final orders that legally recognize heirs. This court reviews evidence and makes determinations regarding heirship disputes, ensuring that all legal protocols are followed and that the rightful heirs are identified. Whether the estate is testate or intestate, the probate process in Mississippi requires opening the estate in the chancery court.

Processing heirship claims through the chancery court ensures the estate’s distribution is handled legally and fairly. The court’s involvement provides a structured and transparent process for resolving heirship issues and transferring ownership of the deceased’s assets.

Notice to Potential Heirs

Legal requirements mandate that notifications be sent to all known heirs and published for unknown heirs, allowing them to come forward during the heirship process. Notices must be published in a local newspaper to inform potential claimants about the heirship proceedings, ensuring all possible heirs have the opportunity to present their claims.

The goal of these notification requirements is to ensure that no potential heir is overlooked, providing a fair chance for all individuals with a legitimate claim to the estate to be heard. This process helps prevent future disputes and ensures that the estate is distributed according to Mississippi’s intestate succession laws.

Determining Heirs Under Mississippi Law

In Mississippi, determining heirs at law in the absence of a will involves following the state’s intestate succession laws. These laws ensure that the deceased’s estate is distributed according to state regulations, prioritizing closer relatives such as the spouse, children, and parents. Heirship suits are necessary to judicially confirm the legal heirs, especially when transferring real estate ownership.

Knowing how heirs are determined under Mississippi law is crucial for families dealing with intestate estates. By following these legal guidelines, families can ensure that the estate is distributed fairly and that all rightful heirs receive their shares.

Priority Order Among Heirs

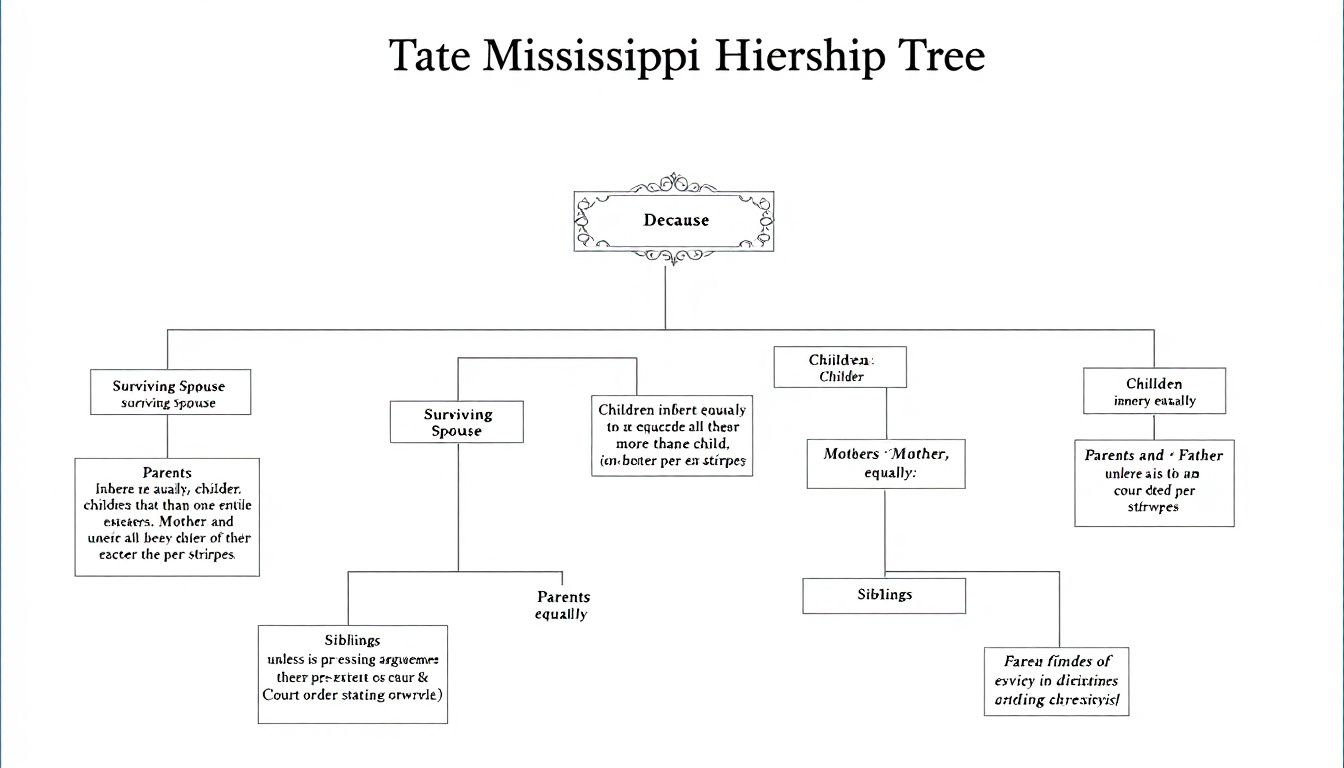

Under Mississippi intestate succession law, the priority order among heirs includes:

- The surviving spouse

- Children

- Parents

- Siblings

- Extended family members

If a decedent has children, the surviving spouse shares the estate with them, receiving half of the estate while the children share the other half. If a child dies before the parent, the deceased child’s share can be inherited by their own children, affecting the distribution of the parent’s assets.

When there are no surviving spouse or children, the deceased’s parents inherit the estate. If there is only one surviving parent, that parent will inherit the full estate. The entire estate goes to the living parent in this case. If there are no surviving parents, spouses, or children, the deceased’s siblings parents inherit the estate equally. If a spouse inherits, the distribution may differ.

Knowing the priority order among heirs ensures the proper distribution of the estate, crucial for estate planning.

Special Considerations for Adopted and Illegitimate Children

In Mississippi, legally adopted children receive the same inheritance rights as biological children, ensuring they are treated equally under the state’s intestate succession laws. Additionally, children born out of wedlock can inherit from their father, provided that paternity is established.

These special considerations ensure that all children, regardless of their birth circumstances, are recognized as rightful heirs and can inherit their fair share of the estate. By understanding these provisions, families can navigate the complexities of heirs property more effectively.

Posthumous Children and Other Relatives

Posthumous children—those born after the decedent’s death—are recognized as heirs under Mississippi law, allowing them to inherit their share of the estate. This legal recognition ensures that even a child born after the parent’s death is entitled to their inheritance.

The escheatment process in Mississippi ensures that distant relatives can still inherit before any property goes to the state, providing a safety net for unclaimed estates. These provisions help families ensure all potential heirs are recognized and the estate is distributed fairly.

Factors Impacting Heirship Determination

Heirship can be influenced by various legal and personal factors, including existing gifts and advancements made during the deceased’s lifetime. These factors can significantly impact the final distribution of the estate, making it essential to understand how they are treated under Mississippi law.

Considering these factors ensures the estate’s distribution is fair and all heirs receive their rightful shares. This section delves into specific elements like advancements, the Slayer Statute, and the process of escheatment.

Advancements and Lifetime Gifts

In Mississippi, property that is given to an heir while the deceased is still alive is classified as an advancement. This amount will be deducted from their portion of the estate. The value of the advancement is deducted from the heir’s share, ensuring that the distribution remains fair. For a gift to be treated as an advancement, the deceased must declare it in writing as such.

Knowing how advancements and lifetime gifts are treated helps families plan the estate’s distribution more effectively. This knowledge ensures that all heirs receive their fair shares, taking into account any previous gifts.

Slayer Statute Implications

The Slayer Statute in Mississippi prevents individuals who unlawfully kill the decedent from inheriting any part of the estate. This statute ensures that those responsible for the wrongful death of the deceased cannot benefit from their actions. The statute applies not just to intentional killings but can also consider negligent actions, depending on the circumstances.

Understanding the Slayer Statute’s implications ensures the estate’s distribution is handled fairly, excluding those not entitled to inherit.

Unclaimed Estates and Escheatment

In Mississippi, if no relatives are found, unclaimed estates are transferred to the state through a legal process known as escheatment. This process ensures that estates without identifiable heirs revert to the state, preventing the property from remaining unclaimed.

Knowing the escheatment process helps families ensure all potential heirs are identified and the estate is distributed according to Mississippi’s intestate succession laws. This knowledge provides a safety net for unclaimed estates, ensuring that they are handled appropriately.

Legal Support for Heirship Claims

Legal assistance is crucial for navigating heirship claims and understanding probate complexities. Legal professionals can assist with the heirship claims process, ensuring compliance with state laws and providing guidance on managing the estate effectively.

Families in Mississippi can benefit from various resources, including community organizations and legal aid services that assist with inheritance issues. Accessing these resources helps families navigate heirship laws more effectively and ensures the estate is distributed fairly.

Hiring an Estate Planning Attorney

Hiring an estate planning attorney is beneficial for families dealing with intestate estates in Mississippi. An experienced attorney can provide essential guidance on the legal requirements, help prepare and file necessary documents, and represent the family in court proceedings. Engaging with a Certified Financial Planner (CFP) can also provide valuable insights into effective estate planning and management.

Estate planning attorneys help families navigate probate complexities, ensuring compliance with Mississippi’s intestate succession laws. Consulting legal professionals ensures all potential heirs are identified and the estate is distributed according to state regulations.

Preparing for Probate Proceedings

Preparing for probate proceedings involves gathering all necessary documents and understanding the legal processes involved. This preparation can significantly streamline the probate process, ensuring that all legal requirements are met and that the estate is distributed fairly.

Engaging with an estate planning attorney and gathering required documentation in advance helps families navigate probate proceedings more efficiently. This proactive approach ensures that the estate is managed effectively and that all potential heirs receive their rightful shares.

Resolving Disputes Among Heirs

Disputes among heirs can arise during the distribution of an estate, but these conflicts can often be resolved through mediation or, if necessary, court intervention. Mediation is a preferred method for resolving conflicts, as it allows the parties to come to an agreement without resorting to litigation.

If mediation fails, court intervention may be required to settle the disputes effectively. Knowing the options for resolving disputes ensures the estate is distributed fairly and all heirs receive their rightful shares.

Resources for Families

Families dealing with heirship issues in Mississippi can access various resources to assist them in managing the estate and navigating the legal processes involved. The Mississippi Center for Justice provides educational resources and direct legal services to help families manage heirship property.

Notices regarding heirship proceedings are published in local newspapers to inform potential heirs and interested parties about the claims. Accessing these resources ensures all potential heirs are identified and the estate is distributed according to Mississippi’s intestate succession laws.

Mississippi Code Sections on Intestate Succession

Relevant Mississippi Code sections on intestate succession include Sections 91-1-1 to 91-1-31. These key sections of the Mississippi Code, particularly Title 91, address the descent and distribution of estates, providing a legal framework for intestate succession in the state.

Understanding these statutes helps families navigate the legal landscape of heirship more effectively. These sections of the Mississippi Code ensure that the estate is distributed according to state regulations, providing a structured approach to managing intestate estates.

Financial Advisors for Estate Planning

Financial advisors play a crucial role in estate planning by helping families navigate complex financial landscapes. Financial advisors offer critical insights for managing estate planning and ensuring fair asset distribution.

Seeking financial advisors’ guidance helps families develop comprehensive estate plans, ensuring effective management. This proactive approach ensures that all heirs receive their rightful shares and that the estate is distributed according to Mississippi’s intestate succession laws.

Online Tools and Guides

Online resources and tools can play a crucial role in helping families understand and navigate heirship and inheritance issues. Websites like Nolo.com offer comprehensive resources on avoiding probate in Mississippi, providing valuable information and guidance for families dealing with intestate estates.

Accessing online tools and guides helps families understand the legal processes involved in heirship determination and estate planning. These resources provide valuable insights and practical advice, helping families navigate the complexities of heirship more effectively.

Summary

In summary, understanding heirship determination in Mississippi is essential for ensuring the fair and orderly distribution of assets when a loved one passes away without a will. By familiarizing themselves with Mississippi’s intestate succession laws, the heirship suit process, and the various factors impacting heirship determination, families can navigate these legal waters more effectively. With the support of legal professionals, financial advisors, and online resources, families can ensure that all heirs receive their rightful shares and that the estate is managed according to state regulations.

Frequently Asked Questions

What is a child entitled to when a parent dies without a will in Mississippi?

A child in Mississippi is entitled to inherit half of the estate if the decedent is survived by a spouse and one child, or to share the estate equally with the spouse if there are multiple children. Thus, the child’s inheritance is determined by the number of surviving children.

What is the role of the chancery court in heirship determination in Mississippi?

The chancery court in Mississippi plays a critical role in adjudicating heirship suits by reviewing evidence, resolving disputes, and issuing final orders that legally recognize heirs. This ensures a clear and official determination of heirship in estate matters.

Who are considered heirs under Mississippi intestate succession laws?

Under Mississippi intestate succession laws, heirs include the surviving spouse, biological and legally adopted children, and blood relatives, as well as posthumous children and those born out of wedlock if paternity is established.

How are advancements and lifetime gifts treated in the determination of heirship?

Advancements and lifetime gifts in Mississippi are considered as part of an heir’s inheritance, and they will be deducted from the heir’s share of the estate if the deceased declared them as advancements in writing. This ensures a fair distribution of the estate among the heirs.

What happens to unclaimed estates in Mississippi?

Unclaimed estates in Mississippi are transferred to the state through a legal process known as escheatment if no relatives or heirs are located. This ensures that the assets are managed by the state rather than remaining in limbo.