What Age Do You Stop Paying Property Taxes in Mississippi

In Mississippi, you may wonder, “What age do you stop paying property taxes in Mississippi?” The answer is at age 65 if you qualify for the senior homestead exemption. This exemption can significantly reduce or even eliminate your property tax burden. In this article, we’ll explore the specifics of this exemption, the eligibility criteria, and the application process to help you navigate property taxes in Mississippi.

Key Takeaways

- Seniors aged 65 and older in Mississippi can apply for a special homestead exemption, providing significant reductions in property taxes and potentially eliminating their tax burden.

- Mississippi offers additional property tax relief programs for disabled homeowners and veterans with service-connected disabilities, allowing for further reductions in property tax liabilities.

- Homeowners must be aware of critical deadlines, including the April 1 application date for homestead exemptions and February 1 for property tax payments, to avoid financial penalties.

Special Homestead Exemption for Seniors

For seniors residing in Mississippi, the special homestead exemption offers a substantial reduction in property taxes. This exemption is available to homeowners aged 65 and older and can significantly reduce or even eliminate their property tax burden. The homestead exemption relieves eligible homeowners from certain ad valorem taxes, significantly aiding seniors in managing their finances.

Qualified seniors benefit from an additional exemption amounting to $7,500, which, when applied, reduces the assessed value of their property by this amount. This reduction leads to an assessed value of just $2,500, providing a significant tax break. The exemption is not just limited to traditional homes; even mobile homes and other types of homestead property may qualify for this relief, ensuring that a wide range of seniors can benefit.

In addition to the general homestead exemption, seniors receive further financial relief that can make a considerable difference in their annual tax bill. Knowing about these exemptions and the application process helps seniors ease their tax burden.

Eligibility Criteria

To qualify for the senior homestead exemption in Mississippi, individuals must meet specific eligibility criteria. Firstly, applicants must be 65 years or older to be considered for the exemption. This age criterion ensures that the relief is directed towards those who are often on fixed retirement incomes and may struggle with high property taxes.

In addition to the age requirement, the property in question must be a single-family, owner-occupied residence. This means that the home must be the primary residence of the applicant. Veterans applying for the exemption need to provide proof of service along with proof of age. Meeting these criteria is necessary for a successful application.

Application Process

Applying for the homestead exemption is a straightforward but necessary process. Unlike some automatic exemptions, residents must actively apply to benefit from this tax relief. This involves filling out specific forms and providing required documentation, all of which can be obtained from the local tax assessor’s office.

Seniors must file their homestead exemption applications with their county by April 1 each year to be eligible for the exemption. Keeping this deadline in mind ensures timely processing of the application. Missing this deadline could mean missing out on substantial tax savings for the year.

Additional Property Tax Relief Programs

Mississippi offers various property tax relief programs specifically designed to assist homeowners, particularly seniors. Beyond the standard homestead exemptions, there are additional programs aimed at further reducing the property tax burden. These programs can provide significant financial relief, especially for those who may not fully benefit from the standard exemptions.

For example, completely disabled homeowners can receive an exemption from all ad valorem taxes up to $7,500 of their home’s assessed value. This relief helps disabled individuals avoid being overburdened by property taxes. Seniors may also qualify for exemptions from certain ad valorem tax reduction based on their home’s assessed value, which may be exempt from ad valorem.

Disabled Homeowners

Disabled homeowners in Mississippi have access to specific property tax exemptions that can provide much-needed financial relief. To qualify, applicants must provide proof of their disability. This ensures that the exemptions are granted to those genuinely in need of support.

In Mississippi, homeowners who are completely disabled can be eligible for property tax exemptions regardless of their age. This means that even younger disabled individuals can benefit from these exemptions, reducing their overall property tax burden and helping them manage their finances more effectively.

Veterans’ Exemptions

Veterans with service-connected disabilities are entitled to specific property tax exemptions in Mississippi. These exemptions can significantly reduce the financial burden on veterans, providing full exemption from property taxes on their homestead. This relief is vital in supporting veterans who have sacrificed for their country.

Veterans with a total service-connected disability are exempt from all ad valorem taxes on their primary residence in Mississippi. This comprehensive exemption ensures that disabled veterans can maintain their homes without the added stress of property tax payments, allowing them to focus on their health and well-being.

Understanding Ad Valorem Taxes

Ad valorem taxes are a central component of property tax calculations in Mississippi. These taxes are based on the assessed value of the property, making them a significant factor in determining the annual property tax bill. Homeowners need to understand how ad valorem taxation works to manage their tax liabilities effectively.

Taxable properties in Mississippi are categorized into five classes, each with its own assessment percentage of true value. For seniors aged 65 or older or disabled individuals, exemptions from certain ad valorem taxes can apply for assessed values up to $7,500. These details help homeowners navigate their property tax in Mississippi responsibilities more easily.

How Ad Valorem Taxes Are Calculated

The calculation of ad valorem taxes involves several steps. The assessed value of a property is determined by multiplying its true value by a state-set ratio. For owner-occupied residential properties, this ratio is 10%. This means that if a property has a true value of $100,000, its assessed value would be $10,000.

Class II properties, which include agricultural, rental, and most vacant properties, are assessed differently. The ad valorem tax for these properties is calculated based on their true value, assessed value, and the applicable millage rates. Higher assessed values generally lead to higher property tax bills, making it essential for homeowners to understand how these values are determined and how they impact their tax obligations.

Millage Rates

Millage rates play a crucial role in determining the amount of property tax owed. A mill is equal to one thousandth of one dollar. This is represented as $.001. These rates are set by municipal, school district, and county authorities, and they contribute to the total property tax calculation.

For example, in DeSoto County, the average property tax rate is 0.67%, while in Shelby County, it is 1.12%. The millage rates can fluctuate over time, impacting the overall property tax burden for homeowners.

Knowing these rates and their implications allows homeowners to better anticipate and plan for their property tax obligations.

Role of the Local Tax Assessor

The local tax assessor plays a vital role in the property tax system. These officials are responsible for evaluating all taxable properties within their jurisdiction to ensure fair and uniform property values. Maintaining up-to-date ownership maps and applying exemptions ensure accurate property tax assessments by local taxing authorities.

Local tax assessors in Mississippi also compile and present property tax rolls to the Board of Supervisors for approval. Once the tax rolls are approved, property tax notices are sent to property owners, informing them of their tax obligations. This process is essential for maintaining an organized and efficient property tax system, which is overseen by county tax collectors.

Property Value Assessments

Property value assessments are a critical function of the local tax assessor’s office. Assessors appraise both real estate and personal property, including business equipment. The assessed value for owner-occupied residential properties in Mississippi is 10% of the market value.

The tax assessor determines property values based on true market value and applies specific assessment ratios depending on the property type. These ratios can be 10%, 15%, or 30% of the appraised value, ensuring that property taxes are calculated fairly and consistently.

Reassessment Cycles

In Mississippi, local property assessors must revalue properties at least once every four years. This reassessment ensures that property values reflect current market conditions, providing a fair basis for property tax calculations.

Homeowners are notified of any reassessment that affects their property tax liabilities. This notification process is crucial for transparency and allows homeowners to understand changes in their property tax obligations. Regular reassessment cycles help maintain accuracy and fairness in the property tax system.

Consequences of Not Applying for Exemptions

Failing to apply for property tax exemptions can have significant financial consequences for seniors. Without the exemptions, seniors may face ongoing tax obligations that could lead to financial strain. The importance of applying for these exemptions cannot be overstated, as they provide crucial financial relief.

Seniors who neglect to file for property tax exemptions may face unaltered tax liabilities, which can be a substantial burden. Understanding the application process and ensuring that all deadlines are met is essential to avoid these potential financial challenges.

Repayment of Credits

If a senior’s exemption is revoked, they are responsible for repaying any tax credits received during the exemption period. This repayment can be a significant financial burden, emphasizing the importance of maintaining eligibility and meeting all application requirements.

In cases where a property tax exemption is denied, individuals may need to reimburse the tax credits they received in prior periods. This can add to their financial strain, making it crucial to ensure that all exemption criteria are met and maintained.

Separate Billing

When a property tax exemption is lost mid-year, individuals will receive separate billing for the taxes owed. This separate billing reflects the new tax status of the individual, impacting their overall tax obligations.

The distinct bill for the remaining tax liability can complicate the financial planning of homeowners. Knowing the implications of losing exemption status and resulting separate billing is crucial for managing property tax payments effectively.

Important Dates and Deadlines

Knowing the important dates and deadlines for property tax exemptions and payments is crucial for homeowners. Applications for homestead exemptions in Mississippi must be submitted between January 2 and April 1 annually. Missing these deadlines can result in lost opportunities for significant tax savings.

The deadline for levying ad valorem taxes in Mississippi is September 15. Millage rates for the next fiscal year are set in September, and once the roll is approved by the Tax Collector, notices are sent out to property owners.

Annual Application Period

The application period for homestead exemptions in Mississippi runs annually from January 1 to April 1. Homeowners must submit their applications by 5:00 PM on April 1 each year.

Applications begin to be accepted at 8:00 AM on January 1, and seniors should visit the Tax Assessor’s Office at 365 Losher Street, Suite 100, Hernando, MS, to apply. Timely submission is necessary to benefit from the exemptions.

Payment Deadlines

Property taxes in Mississippi must be paid by February 1 each year to avoid penalties. Late payments incur penalties after February 1, starting at a rate of 1% per month. Knowing these deadlines and planning accordingly helps homeowners avoid extra financial burdens.

Prompt payment ensures compliance and avoids unnecessary penalties.

How to Pay Property Taxes

There are various methods available for paying property taxes in Mississippi, including in-person, online, and by mail. Each method has its own set of instructions and requirements, making it important for homeowners to choose the most convenient option.

In Jackson County, property tax payments must be made using certified funds after June 30th. Understanding these specific requirements can help ensure that payments are processed smoothly and without delay.

In-Person Payments

In-person payments for property taxes are a traditional method that many homeowners still prefer. In Jackson County, Mississippi, after June 30th, these payments must be made using certified funds. This requirement ensures that the funds are secure and immediately available, reducing the risk of payment issues.

For those who prefer this method, it’s essential to visit the tax collector’s office during business hours and bring the necessary certified funds, such as a cashier’s check or money order. Having the correct payment method ensures a smooth transaction and helps avoid penalties or delays.

Online and Mail Payments

Online and mail payments provide convenient alternatives to in-person transactions. Mississippi’s online payment system allows homeowners to pay their property taxes using credit cards or e-checks. While this method is convenient, it’s important to note that online payments may incur additional convenience fees, especially when using credit or debit cards.

For those who prefer mailing their payments, specific instructions are provided for different types of property, including real property, personal property, and mobile homes. Mail payments should be sent well before the deadline to ensure they are received and processed on time. An e-check option is also available, which incurs a flat fee of $1.50, regardless of the amount paid.

Impact of Property Tax Revenue

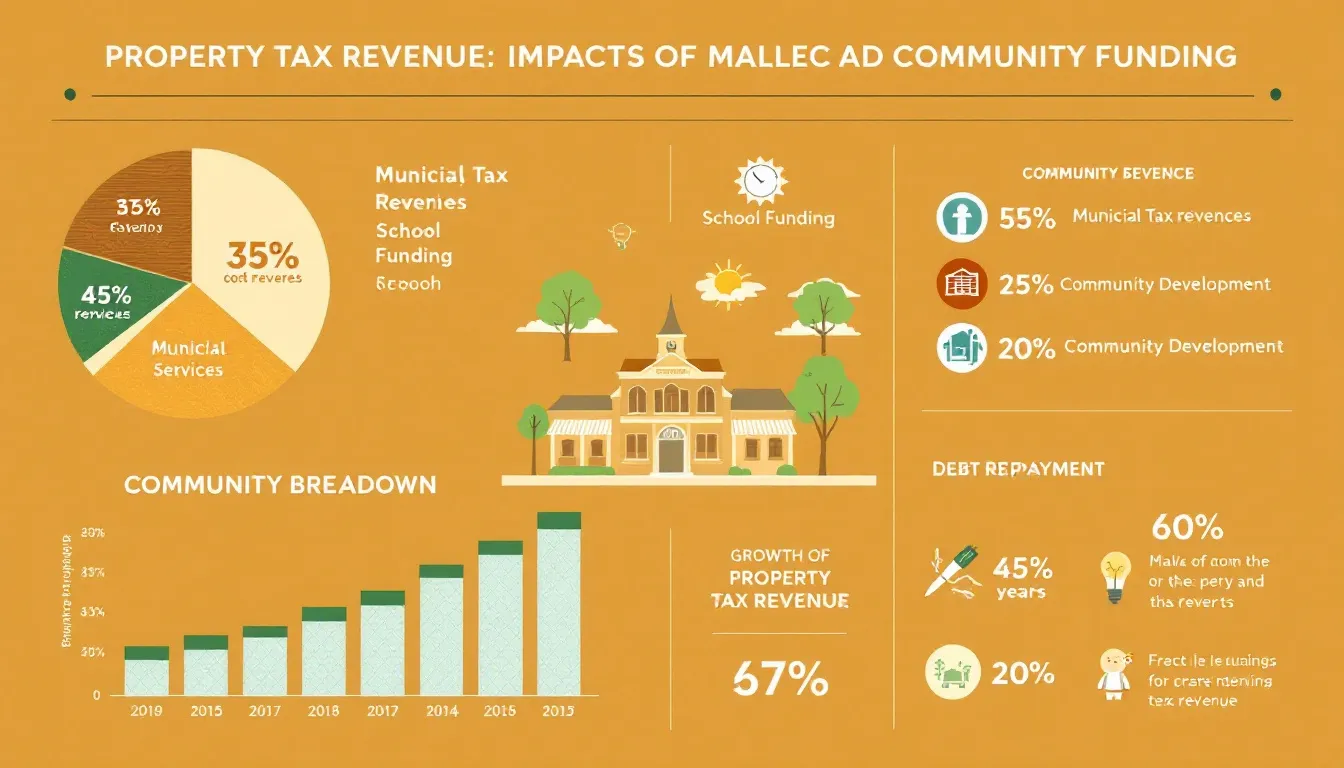

Property tax revenue is a vital source of funding for local governments in Mississippi. These funds account for more than 75% of the revenue for counties, making them the primary funding source for many essential services. Recognizing the impact of property tax revenue underscores the importance of timely and accurate payments.

This revenue supports a wide range of public services, including fire protection, law enforcement, infrastructure maintenance, and emergency services. These services are crucial for maintaining the quality of life in communities across Mississippi, highlighting the broader importance of property tax contributions.

County General Fund

The county general fund is a significant beneficiary of property tax revenue. This fund is used to provide various essential public services, such as law enforcement, infrastructure maintenance, and other community services. The revenue collected from property taxes ensures that these services are adequately funded and can operate effectively.

In addition to public services, property tax revenue also supports educational initiatives and the operation of separate school districts within the county. This financial support is crucial for maintaining and improving the quality of education, which benefits the entire community.

School District Purposes

Property tax revenue plays a significant role in financing education in Mississippi. These funds help cover both instructional and non-instructional services across various school districts. By supporting education, property tax revenue contributes to the development and success of future generations.

In addition to instructional services, property tax revenue is also used to cover long-term debt interest and other financial obligations of the school districts. This comprehensive support ensures that schools can provide high-quality education and maintain their facilities.

Summary

Navigating the complexities of property tax exemptions and relief programs in Mississippi can seem overwhelming, but understanding these options is crucial for seniors looking to manage their finances effectively. The special homestead exemption for seniors provides significant tax relief, reducing or even eliminating property taxes for eligible homeowners.

In addition to the homestead exemption, other relief programs are available for disabled homeowners and veterans, offering further financial support. Understanding how ad valorem taxes are calculated and the role of millage rates can help homeowners anticipate their tax obligations and plan accordingly.

The role of local tax assessors is vital in ensuring fair property valuations and the application of exemptions. Meeting important deadlines and knowing the payment methods available can prevent unnecessary penalties and ensure timely tax payments. By understanding and utilizing these exemptions, seniors can significantly reduce their property tax burden and enjoy a more financially secure retirement.

Frequently Asked Questions

At what age do you stop paying property taxes in Mississippi?

Homeowners aged 65 and older in Mississippi may qualify for a special homestead exemption that can reduce or eliminate their property taxes.

What is the deadline to apply for the homestead exemption in Mississippi?

The deadline to apply for the homestead exemption in Mississippi is April 1 each year. Ensure to submit your application by this date to benefit from the exemption.

Can disabled homeowners qualify for property tax exemptions in Mississippi?

Yes, completely disabled homeowners in Mississippi can qualify for property tax exemptions, regardless of their age.

How are ad valorem taxes calculated in Mississippi?

Ad valorem taxes in Mississippi are calculated by taking the assessed value of the property, which is determined by multiplying its true value by a specific state-set ratio. Thus, understanding both the property’s true value and the applicable ratio is essential for accurate tax calculations.

What happens if I lose my property tax exemption mid-year?

Losing your property tax exemption mid-year results in separate billing for the taxes owed for the remaining portion of the year. It is essential to budget accordingly to accommodate this additional financial obligation.