I’ve Got a Long-Term Care Policy. Should I Stop Paying or Keep It?

If you’ve had a long-term care policy for several decades and have continued to pay the premiums, this is an important component of being able to protect yourself against decimating your savings. However, many people who have long term care policies have reported that these premiums have increased significantly in recent years.

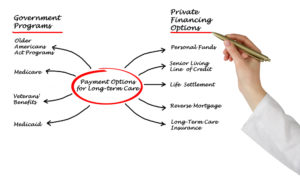

Some people are concerned about whether or not they should let the policy lapse or continue paying on it. The decision about whether or not to continue paying the premiums on your long-term policy can only be made after evaluating your individual financial situation. If you have significant assets but no long-term care policy, a sudden incapacitating event that sends you or your spouse to the nursing home, could completely eliminate all of your savings.

With substantial assets, you may not be able to get support for Medicaid, at least for a period of time after you’ve spent down your individual assets and wealth. A long-term care policy must be carefully considered as part of your vision. While many companies used to offer long term care insurance, many of those smaller businesses ultimately closed up shop after becoming insolvent. Today there are only a few major insurance companies that offer long term care. The older long-term care policies will typically have better benefits than the newer ones, so allowing your long-term care policy to lapse could be a big mistake if you are not careful.